2018/06/09

Amazon has been making waves in different parts of the healthcare industry over the past 12 to 24 months, but its recently announced alliance with JPMorgan Chase and Berkshire Hathaway demonstrated that Amazon’s ambitions go much further than simply selling healthcare products. True, the initiative is still in its infancy and is limited to employees of the three partners, but the statement sparked a flurry of speculation and sent the stocks of insurers and major healthcare companies into a tailspin. Many industry watchers are now asking: How far will Amazon, the master disrupter, take this?

The answer: very far, it’s safe to assume. Anyone who continues to think of Amazon as just a very big digital retailer needs to think again. From an online bookstore, to an online everything store, to a leader in cloud computing, to a business-to-business (B2B) ecommerce platform, to a provider of in-home services, to a brick-and-mortar food purveyor — over the course of its existence, Amazon has continued to expand on its original business model. The company has repeatedly shown that it has the capabilities, the patience and the deep pockets to disrupt industry after industry. Healthcare is no exception.

L.E.K. Consulting has three reasons to believe Amazon is serious about healthcare. First, as one of the largest private employers in the U.S., Amazon would reap huge financial benefits from lowering the high cost of healthcare in this country. Second, the numerous inefficiencies of the healthcare system present enticing avenues for Amazon to explore, and as CEO Jeff Bezos has famously stated, “Your margin is my opportunity.” Finally, healthcare is just the kind of big, complex problem that Bezos likes to sink his teeth into. An unabashed “Star Trek” fan with a utopian view of the future, Bezos has always aspired “to boldly go where no one has gone before.” The fact that he has personally invested billions in space exploration with his company Blue Origin shows he is willing to put his money where his mouth is. While healthcare poses a more earthbound challenge, Bezos strongly believes that Amazon has a role to play in making things better.

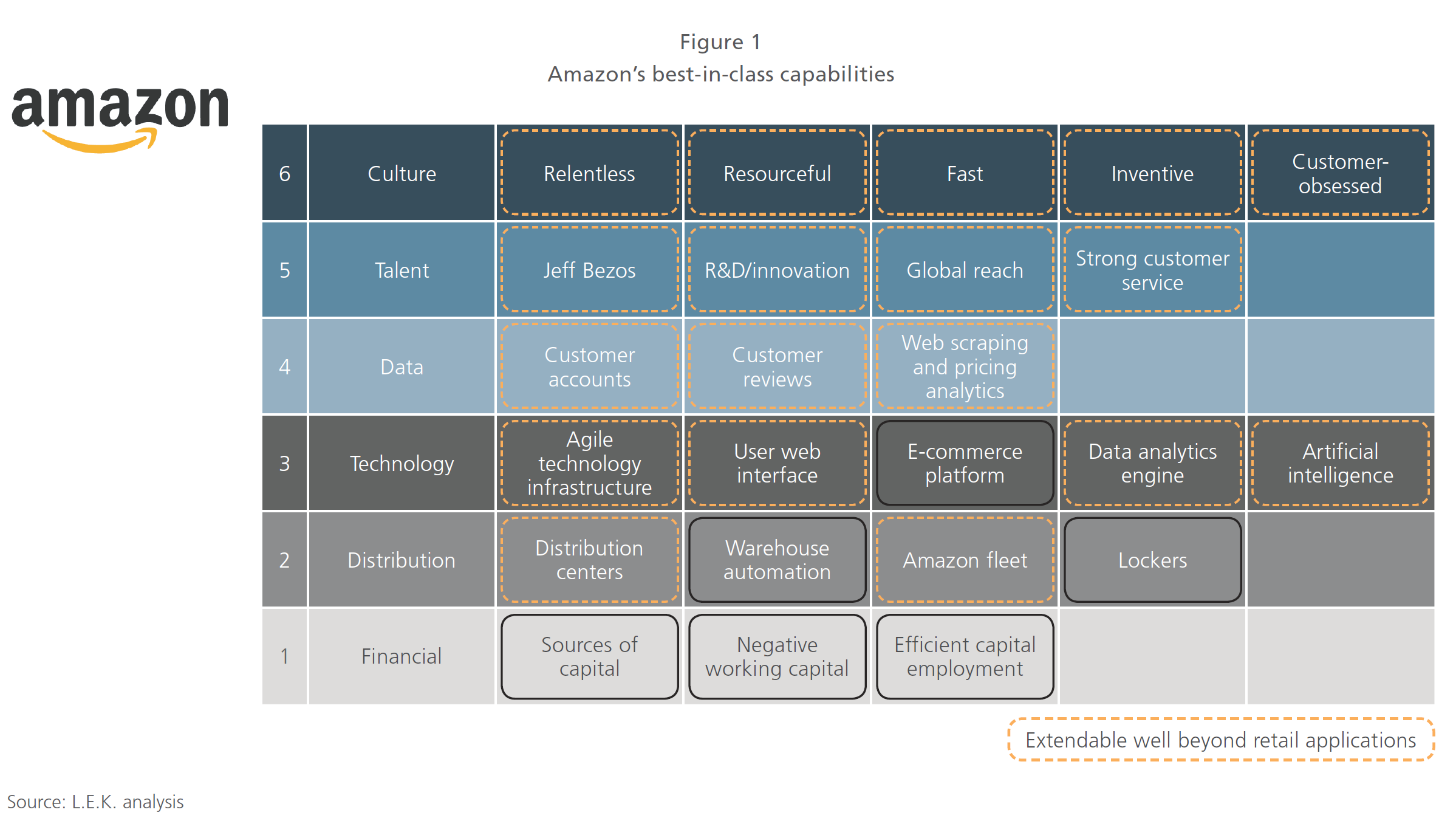

Indeed, Amazon has many of the core competencies that are needed to compete in healthcare — from data analytics to technology and innovation (see Figure 1). Furthermore, the company is already testing the waters both at home and in markets outside the United States. For example, in Japan it will begin offering Prime Now drug deliveries directly to consumers who have approval from a pharmacist. Stateside, the company has begun recruiting for multiple healthcare-related positions, and some news outlets have reported that it has a clandestine health team working on medical records and virtual doctor visits. Its joint initiative with JPMorgan Chase and Berkshire Hathaway will give it broad leeway to experiment and learn more about operating in this space before entering it more aggressively.

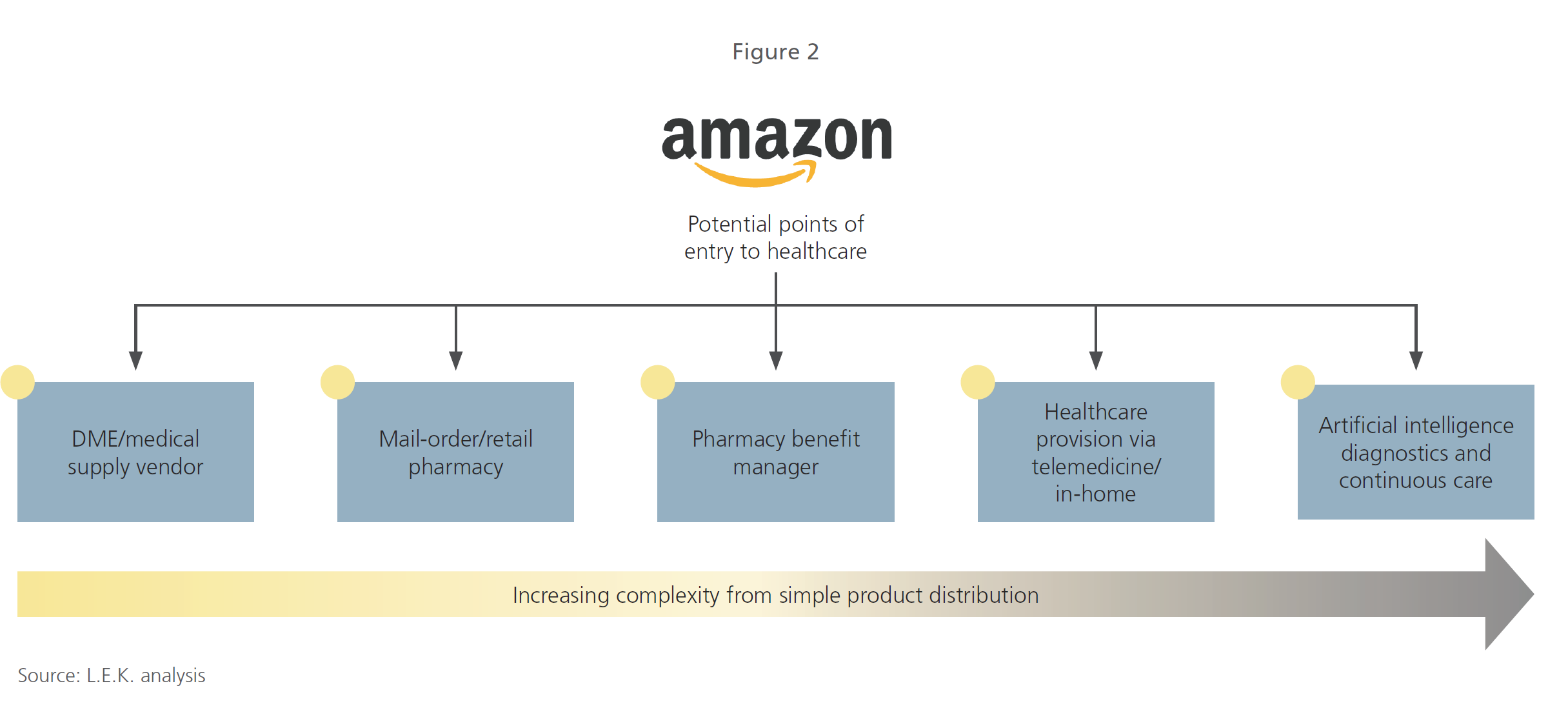

As Amazon turns its aggressive focus to healthcare, what will the onslaught look like, and what might the impact be across different parts of the healthcare landscape? We believe there are five potential points of entry, with increasing levels of complexity from simple product distribution (see Figure 2).

As Amazon turns its aggressive focus to healthcare, what will the onslaught look like, and what might the impact be across different parts of the healthcare landscape? We believe there are five potential points of entry, with increasing levels of complexity from simple product distribution (see Figure 2).

1. Durable medical equipment and medical supplies

This one is a no-brainer because Amazon is already there: It currently sells a broad array of general medical supplies and durable medical equipment (DME) to consumers. Given its core competencies in logistics and distribution and its existing B2B ecommerce platforms, expansion into wholesale distribution is a logical next step. In fact, the company has already obtained licenses to distribute medical supplies directly to providers in a variety of medical settings in 43 states. In those states, licensed professionals can enroll in the Amazon Business Professional Healthcare program to order restricted-access products.

If Amazon begins selling to hospitals, this could significantly disrupt the established group purchasing organization (GPO) contracting model. As a result, some original equipment manufacturers (OEMs) are already starting to sell older or more established equipment directly into hospitals without sales reps. On the business-to-consumer (B2C) front, Amazon could also disrupt the self-pay DME market by providing price-transparent, simplified online platforms for patients to buy consumable or durable DME for in-home use. Increased transparency and disintermediation for both B2B and B2C markets will likely lead to price reductions and margin compression. This is a wake-up call for existing DME and medical supply retailers, who will need to focus on greater customer engagement in the purchasing process.

2. Mail-order and retail pharmacy

Amazon appears to also have mail-order pharmacy players in its sights. It has secured approval as a wholesale distributor from 12 state pharmaceutical boards. While the company faces some hurdles in complying with drug storage and distribution regulations, these challenges are hardly insurmountable. Amazon has another ace in the hole with its recent acquisition of Whole Foods. Stores could be used to house brick-and-mortar pharmacies that would be powered by Amazon’s mail-order fulfillment capabilities. Amazon has other significant capabilities that strengthen its position in this space. For example, its digital platform, predictive analytics and customer data could be leveraged to create digital health tools that track and influence patient behavior. This, in turn, might give it entry into some of the less intuitive areas of healthcare delivery.

Should Amazon choose to enter the mail-order pharmacy space, its ability to quickly deliver products (Prime Now is striving for two-hour delivery times) would put pressure on existing mail-order pharmacies to improve delivery times for essential prescriptions. Traditional retail pharmacies are also likely to feel the heat and may have to respond by diversifying their offerings (for example, by offering blood tests). Furthermore, if Amazon can come in as a low-cost player, existing pharmacies and pharmacy benefit managers (PBMs) will almost certainly experience margin compression.

3. Pharmacy benefit manager

PBMs leverage the combined purchasing power of health plan enrollees to lower prices for prescription drugs, a strategy with which Amazon is certainly familiar. Because the PBM market is fairly consolidated, Amazon would most likely enter the space either by partnering with a large PBM such as Express Scripts or by purchasing a smaller player like Prime Therapeutics. This would give it access to the requisite claims adjudication systems and networks of pharmacies. Its relationship with millions of Amazon Prime customers makes it an attractive partner for a PBM, and once again its data-analytic capabilities could be leveraged to improve patient compliance and health behaviors. As with other sectors, if Amazon became a low-cost PBM alternative, this would apply downward pressure on prices, and existing PBMs might need to create more user-friendly offerings (e.g., online portals, tracking).

4. Telemedicine or in-home healthcare

The three points of entry discussed above leverage Amazon’s capability in logistics and distribution, as well as its ability to negotiate rock-bottom prices. But Amazon has shown that it’s more than a distributor of boxes. With its deep knowledge of machine learning, the company has launched its enormously successful Echo, a smart speaker that connects to the voice-controlled intelligent personal assistant service Alexa, currently the market leader. With more than 20 million Echos sold in the U.S. to date, the possibilities for rolling out a host of new voice-activated services are extensive, and healthcare could be among them. Indeed, Bezos has talked publicly about the role for Alexa in the future of healthcare delivery.

The first step toward this could be offering telemedicine through current Echo devices whereby Alexa would contact available physicians for a consultation. The Echo Show, which combines traditional smart speakers with a screen, provides the opportunity for video telemedicine, helping with conversion as consumers become familiar with the concept of in-home healthcare. The next step could be for Amazon to facilitate frictionless in-home visits from provider networks at simple, transparent prices. A move like this could apply downward pressure on the price to treat common illnesses at doctors’ offices or walk-in clinics and could force those establishments to diversify their services (for example, by offering telemedicine, late-night hours, weekend hours or in-home nurse visits).

Of course, Amazon’s leading the “Uberization” of medicine is hardly a shoo-in. Developing provider networks could prove a challenge unless the company is able to acquire some existing telemedicine providers. Furthermore, there is no guarantee that consumer trust in Amazon would transfer to the area of personal healthcare. But it remains a potential direction, and one that healthcare providers should take seriously.

5. Artificial intelligence-powered diagnostics and continuous care

There is every sign that Bezos’ long-term vision for Amazon could start to disrupt healthcare provision as we know it, and the last frontier to feel the impact of that vision may be in-home diagnostics and care delivered through artificial intelligence (AI). Amazon has already made tremendous strides in AI, as witnessed by Alexa’s burgeoning capabilities. In fact, one of Alexa’s “skills” — first-aid information and voice-driven self-care instructions for a variety of situations — has been implemented by none other than the famed Mayo Clinic.

Machine learning drives many of Amazon’s offerings, from its customer recommendation engine to optimization at its service centers. A conceivable next step for Amazon could be to use its AI capabilities to turn Echo into an in-home diagnostic tool, without the need for a human doctor. The company could seek to further remove the human element from basic healthcare by leveraging next-generation Alexa technology (for example, offering a first-line diagnosis, providing reminders to take meds and auto-replenishing prescriptions).

Some consumers may resist the idea of receiving healthcare advice without the involvement of a medical professional, and certainly the idea would face regulatory and safety hurdles — not to mention pushback from physician organizations such as the American Medical Association. Nevertheless, removing medical professionals from basic diagnostics would drastically lower cost-to-serve, applying downward pressure on volume and price for doctor and nurse practitioner visits. Furthermore, if Amazon were to apply commercial principles to healthcare referrals (for example, by creating a service marketplace or instituting pay-to-play), this could profoundly disrupt traditional referral patterns.

To live long and prosper, keep Amazon on your radar

Many people, including business executives, continue to view Amazon through the lens of their personal experience as consumers — meaning they tend to think of it as an online retailer. But dismissing Amazon as a master mover of boxes would be a big mistake. It is at core a technology company, and it is driven by a central belief that technology can be applied to most problems. Jeff Bezos has made it abundantly clear that he considers healthcare to be one of those problems, and that it fits within the company’s vision to tackle it. With a relentless and resourceful culture, an effective global distribution network, and an agile technology infrastructure, Amazon has the potential to make meaningful strides toward realizing that vision. Any players in the space would do well to move beyond having a mere digital strategy and step up their game by developing an Amazon strategy. After all, with a founder who finds a touchstone in the starship Enterprise, Amazon is likely to find new frontiers just about everywhere it goes.

About the Authors

Robert Haslehurst is a Managing Director and Partner in L.E.K. Consulting’s Boston office and is focused within the Retail and Consumer Products practices. He has been with L.E.K. since 2000 and has extensive experience working with both retailers and consumer brands in the U.S. and globally. Rob advises clients on a range of issues, including corporate strategy, consumer insights, new product development, program management, corporate finance, and mergers and acquisitions.

Joe Johnson is a Managing Director and Partner, as well as the head of L.E.K. Consulting’s New York office. He is one of the leaders in L.E.K.’s Healthcare Services practice and plays an instrumental role in helping senior executives across the industry develop and implement new strategies to address sweeping federal healthcare reforms that are having a significant impact in this market.

Source:L.E.K. Consulting 2018-03-22